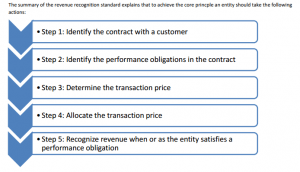

As mentioned in FASB ASC 606-10-05-4:

An entity recognizes revenue in accordance with the core principle by applying the following steps:

Source

So what does this mean for you?

Well, it means quite a bit of changes to the way your business is managed and how it operates. Everything from accounting, sales, IT systems, compliance, controls and the list goes on.

Let’s take a brief look at how some of these functions may be impacted:

Sales: organizations may reconsider contract terms for current contracts to maintain or to achieve a specific revenue profile.

Accounting: new information is to be captured at its source which means new processes will need to be implemented to capture that data.

Systems/Software: existing systems may need to be changed or new systems implemented in order to capture the data and maintain parallel records.

Our experience has been that every organization manages and operates differently which means that some out of the box software can be missing many key components to help stay in compliance or effectively track the necessary information.

When you are searching for a solution make sure to take the following into consideration:

- Look for a system/software that can be tailored to your needs when compliance standards change (just like the New Revenue Recognition Standard);

- Work with a team that looks at your entire operations and guides you through the process (not just sells a software…they must understand all aspects of how the solution impacts your entire organization);

- Discuss with your IT personnel the good and bad of having a contract management solution hosted (in the cloud) or on-premise (installed on your organization’s servers);

There are many more areas to discuss, but for now we will keep it simple and provide more updates as time goes on.

Helping You Simplify the Management of Contracts,

Luis Camarena